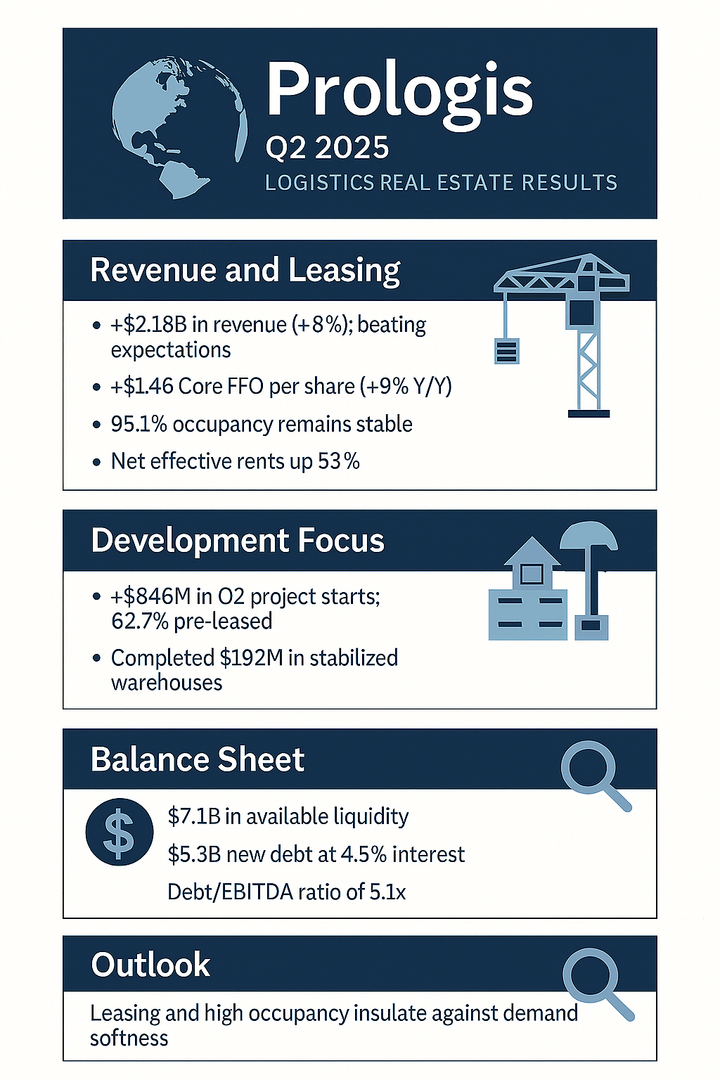

5 Metrics Every Real Estate Investor Should Watch in 2025

By Andres Cisneros-Romo

Real estate investing has always been driven by numbers, but in 2025, with interest rates, construction costs, and market dynamics evolving rapidly, understanding the right metrics is more critical than ever. Successful investors go beyond headline rent prices or market hype and rely on performance indicators like Net Operating Income (NOI), Debt Service Coverage Ratio (DSCR), Internal Rate of Return (IRR), Cap Rates, and Loan-to-Value (LTV) ratios to guide their decisions.

Here’s a breakdown of these five essential metrics and why they matter in 2025.

Net Operating Income (NOI)

What It Is:

NOI measures a property's profitability before financing costs and taxes. It’s calculated by subtracting operating expenses from gross rental income.

Formula:

NOI = Gross Income – Operating Expenses

Why It Matters in 2025:

With rising insurance premiums, property taxes, and maintenance costs, NOI is under pressure in many markets. Investors must monitor NOI closely to evaluate true cash flow. For multifamily investors, NOI is also the foundation for determining property value since most commercial real estate is appraised based on income rather than comparable sales.

Tip: Improving NOI by reducing expenses (e.g., energy-efficient upgrades) or increasing rents can significantly boost property valuations.

Debt Service Coverage Ratio (DSCR)

What It Is:

DSCR indicates a property’s ability to cover its debt obligations. It’s calculated by dividing NOI by annual debt service (principal + interest payments).

Formula:

DSCR = NOI ÷ Debt Service

Why It Matters in 2025:

As lending standards tighten, lenders prefer properties with DSCRs above 1.25, meaning NOI is at least 25% higher than debt payments. Higher interest rates have made it harder for properties to meet this threshold, impacting refinancing and acquisition strategies.

Tip: Investors should run stress tests to see how rising expenses or small drops in occupancy affect DSCR, especially for bridge loans or floating-rate debt.

Internal Rate of Return (IRR)

What It Is:

IRR measures the expected annualized return on a real estate investment, factoring in both cash flow and eventual sale proceeds. It’s one of the most comprehensive metrics for evaluating long-term performance.

Why It Matters in 2025:

Investors are becoming more cautious in their assumptions about appreciation and rent growth. A strong IRR, typically 8–15% for value-add projects, signals that an investment will outperform even in a slower economic environment.

Tip: Always compare IRR to other investments with similar risk profiles, such as REITs or stocks, to ensure the property offers competitive returns.

Capitalization Rates (Cap Rates)

What It Is:

Cap rates show the relationship between a property’s NOI and its purchase price, serving as a measure of return if the property were bought with cash.

Formula:

Cap Rate = NOI ÷ Purchase Price

Why It Matters in 2025:

Cap rates have shifted due to higher interest rates and risk premiums. In 2024, many Sunbelt markets saw cap rates rise 25–50 basis points, creating both challenges and opportunities for investors. A higher cap rate usually means a lower purchase price relative to income, but it can also signal market risk.

Tip: Watch for cap rate compression in markets with strong in-migration and job growth, as these areas may offer better long-term value.

Loan-to-Value Ratio (LTV)

What It Is:

LTV measures how much of a property’s value is financed with debt compared to equity.

Formula:

LTV = Loan Amount ÷ Property Value

Why It Matters in 2025:

Most lenders are now capping LTVs at 60–70%, down from 75–80% in past years. This means investors must bring more equity to the table, making deal structuring crucial.

Tip: A lower LTV reduces risk during downturns, as properties are less likely to be “underwater” if values decline. However, it can also lower overall returns if equity contributions are too high.

The Bottom Line

Understanding NOI, DSCR, IRR, Cap Rates, and LTV trends gives investors a clearer picture of both risk and reward. In 2025, with capital markets tightening and regional markets behaving differently, these metrics are essential tools for navigating the landscape.

By tracking these numbers and adjusting strategies accordingly, investors can position themselves to capitalize on opportunities while mitigating risk.

Investor Takeaway

- Focus on fundamentals: Properties with strong NOI and DSCR are best positioned to weather rate volatility.

- Evaluate IRR conservatively: Overly optimistic rent growth assumptions can skew projections.

- Watch market-level cap rate shifts: Higher cap rates can present acquisition opportunities in undervalued markets.

- Stay liquid: With lower LTV allowances, investors with cash reserves will have a competitive edge in 2025.