Accessing Affordable Housing in Texas: What Cost-Burdened Residents Need to Know

By Andres Cisneros-Romo

July 13, 2025

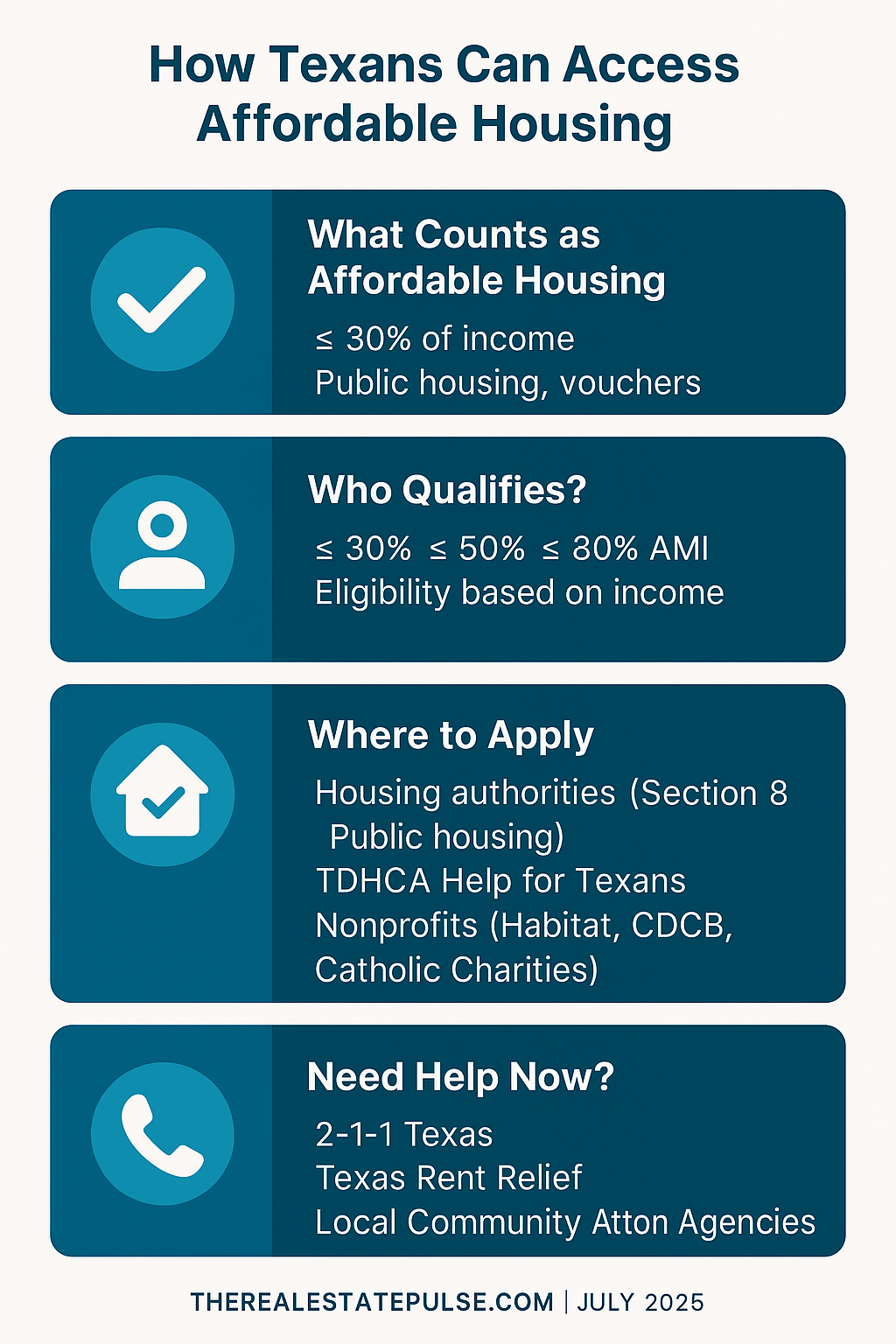

Across Texas, housing costs continue to rise while wages remain relatively flat—leaving many residents wondering how they’ll afford rent or buy a home. Nearly half of all renters in Texas are considered cost-burdened, meaning they spend more than 30% of their income on housing. For these individuals and families, affordable housing is not just a buzzword—it’s a lifeline.

But what is affordable housing, and how can Texans access it?

Let’s break it down.

What Is “Affordable Housing”?

Affordable housing is defined by the U.S. Department of Housing and Urban Development (HUD) as housing that costs no more than 30% of a household’s gross income, including rent or mortgage payments and utilities. If you’re paying more than that, you’re officially “cost-burdened.”

Affordable housing comes in different forms:

- Public Housing: Government-owned properties available to low-income residents.

- Project-Based Rental Assistance (PBRA): Subsidies tied to specific properties, reducing rent for qualifying tenants.

- Housing Choice Vouchers (Section 8): Portable rental assistance that lets tenants rent from private landlords.

- LIHTC Properties: Privately owned developments built or maintained using Low-Income Housing Tax Credits, offering reduced rents to qualified tenants.

Who Qualifies for Affordable Housing in Texas?

Eligibility is based primarily on household income relative to the local Area Median Income (AMI). Most programs fall into these bands:

- Extremely Low-Income: ≤30% of AMI

- Very Low-Income: ≤50% of AMI

- Low-Income: ≤80% of AMI

Example: In Houston (2025), a family of four earning less than ~$55,000/year would typically qualify as low-income.

Other factors that may impact eligibility:

- Family size

- Citizenship or legal residency status

- Criminal history

- Rental history

Each program or property has its own screening process, but income is always a key factor.

How to Apply for Affordable Housing in Texas

Here are the main pathways to find and apply for affordable housing:

1. Local Housing Authorities (LHAs)

Texas has dozens of local housing authorities (e.g., Houston Housing Authority, Dallas Housing Authority, Brownsville Housing Authority) that administer:

- Public housing units

- Section 8 Housing Choice Vouchers

Steps:

- Visit your local housing authority contact list via HUD.

- Check if the waitlist is open.

- Submit an application (usually online).

- Be prepared for documentation: proof of income, identification, etc.

Tip: Waitlists can be years long—apply early and follow up regularly.

2. Texas Department of Housing & Community Affairs (TDHCA)

TDHCA oversees:

- LIHTC developments

- HOME and National Housing Trust Fund rental programs

- Rental assistance and homebuyer aid

Use the TDHCA Help for Texans Tool to search for:

- Affordable rental units

- Emergency rent assistance

- Homebuyer and down payment programs

3. Nonprofit and Faith-Based Providers

Organizations like:

- Habitat for Humanity Texas

- BCL of Texas

- cdcb | come dream. come build.

- Catholic Charities of Texas (search by region)

These groups often offer:

- Below-market homeownership opportunities

- Financial education and credit repair

- Emergency or transitional housing

4. LIHTC (Low-Income Housing Tax Credit) Properties

LIHTC units are privately owned but rent-restricted to low- and moderate-income households.

Use these tools to search available units:

Apply directly through the property manager—LIHTC units are not administered by local housing authorities.

What If You're Facing Housing Instability Now?

If you’re currently at risk of eviction or homelessness:

- Call 2-1-1 Texas or visit www.211texas.org — connects you to rent assistance, shelters, legal help, and more.

- Visit Texas Rent Relief — while the main program closed, check for new funding rounds or referrals to local aid.

- Contact your local Community Action Agency for emergency utility, rental, or housing support.

Final Thoughts: Affordable Doesn’t Mean Inferior

Affordable housing is often misunderstood as substandard or limited to public housing—but in today’s market, it’s a necessity for working families, veterans, seniors, and young professionals alike. From LIHTC apartments to down payment assistance and rental subsidies, there are multiple options available.

The process takes patience—and often persistence—but support exists. Whether you're applying for a voucher, looking to rent below market, or exploring first-time homeownership programs, the key is to start early, document your income, and explore every option available in your city or county.

Resources

- 🔗 TDHCA Help for Texans Tool

- 🔗 HUD Local Housing Authority Directory (TX)

- 🔗 AffordableHousingOnline.com

- 🔗 TDHCA Affordable Property Search

- 🔗 2-1-1 Texas

- 🔗 Texas Rent Relief

- 🔗 Texas Community Action Agencies

For more policy, market, and housing access coverage across Texas and beyond, subscribe to TheRealEstatePulse.