Austin Multifamily Shows Early Signs of Stabilization

By Adrian Cisneros-Romo

According to Bisnow, Austin is expected to see positive multifamily rent growth after a period of decline driven by record supply deliveries. This follows several quarters of rent compression as new units outpaced absorption, pressuring both lease-up velocity and effective rents.

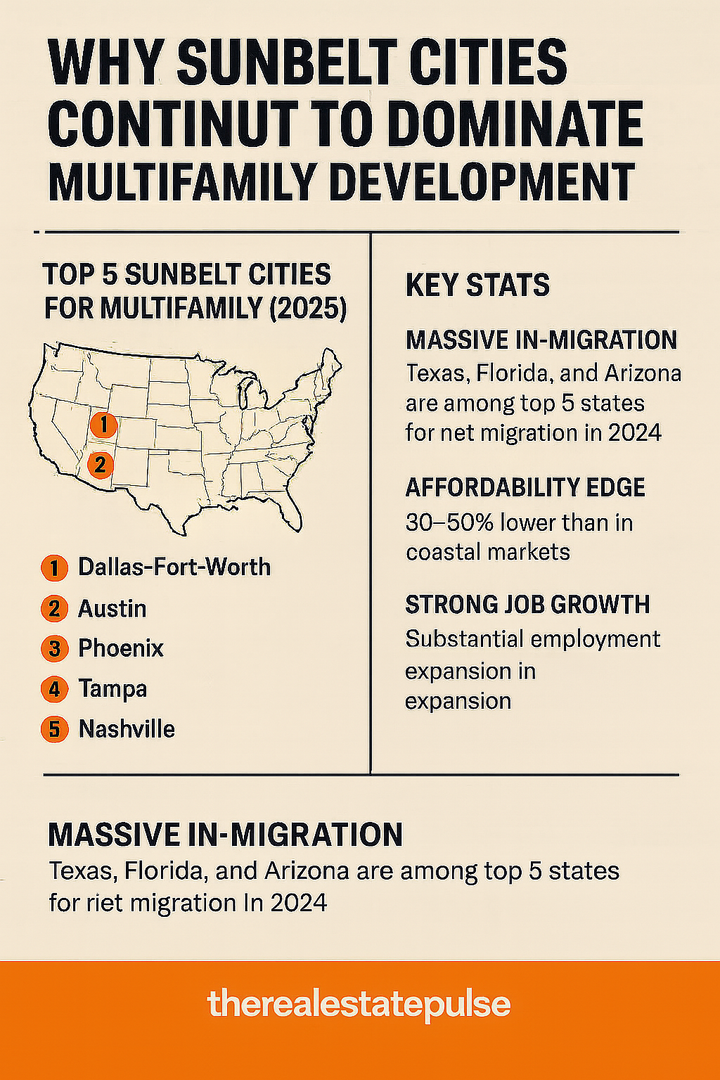

The significance here is directional. While growth is expected to be modest, the shift from negative to positive rent movement suggests that demand is beginning to catch up with supply. Austin remains one of the most construction-heavy markets in Texas, making it a useful leading indicator for how fast-growing Sunbelt metros absorb excess inventory.

For investors, this does not imply a return to peak pricing or aggressive rent assumptions. Instead, it signals that the worst of the supply-driven correction may be behind the market, reducing downside risk for acquisitions underwritten with conservative growth and realistic exit caps.

Investor takeaway: Austin multifamily may be transitioning from a defensive posture to a more selective opportunity, particularly for buyers focused on basis, operational execution, and longer hold periods.