Cap Rates Plateau: Is a Pricing Floor Emerging?

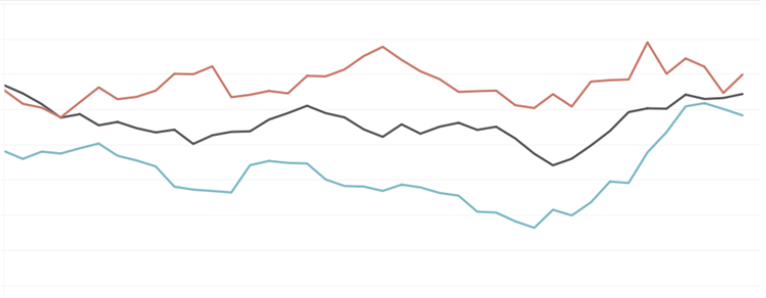

The cap rate plateau suggests a potential pricing floor may be forming. According to GlobeSt, many investors now believe the “top” of cap rates is near, as yields appear to be stabilizing after the sharp repricing cycle between 2022 and 2024, particularly in stabilized multifamily and industrial assets.

This does not mean cap rates are compressing. It means much of today’s appraised value already reflects the forced repricing driven by rate shocks from 2021 through 2023. Transaction activity remains selective, but buyers and sellers are beginning to align on pricing.

For Texas-based investors, underwriting assumptions may need to be adjusted. If cap rate expansion is no longer the dominant directional force, basis discipline and exit timing will likely matter more than waiting for further yield drift.

Investor Takeaway: The repricing phase may be nearing maturity. Focus on durable cash flow and entry basis rather than expecting significantly wider yields.