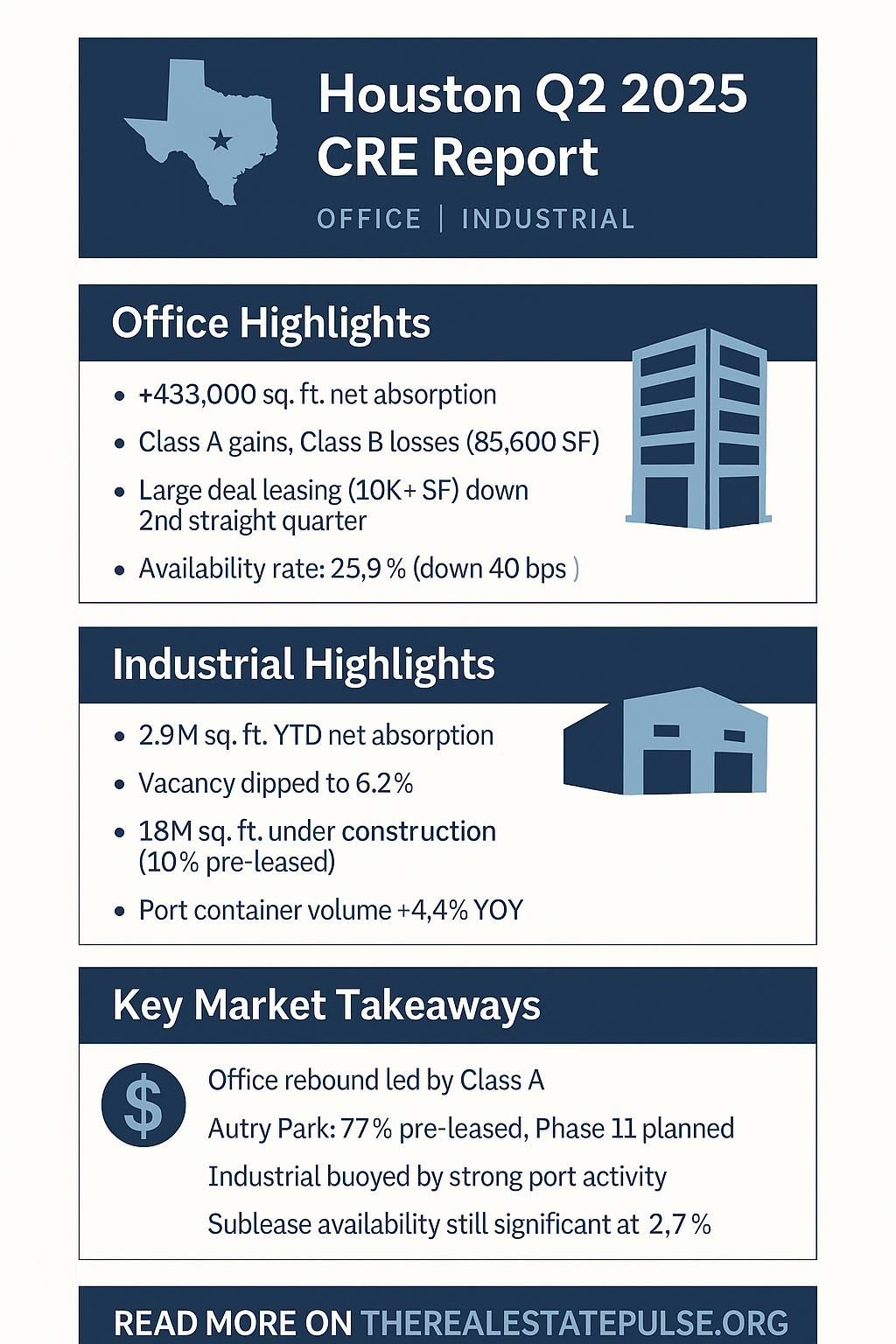

Houston Q2 2025 CRE Report: Office Rebounds, Industrial Powers Forward

July 7, 2025 | By TheRealEstatePulse Editorial Staff

Houston’s commercial real estate market gained momentum in Q2 2025 as the city’s office sector recorded its strongest net absorption in four years, and its industrial market continued to outperform with solid absorption, low vacancy, and record port activity.

Office Market: Positive Absorption Returns to Houston

After several quarters of contraction post-COVID, Houston’s office market saw a significant recovery in Q2 with over 433,000 sq. ft. of positive net absorption—the highest quarterly total since 2021.

This absorption was concentrated in Class A buildings, particularly in the Central Business District (CBD) and The Woodlands. Meanwhile, Class B space struggled, posting a net loss of 85,600 sq. ft., underscoring the widening gap between top-tier and aging office inventory.

Leasing activity for deals over 10,000 sq. ft. declined for the second straight quarter, totaling 1.6 million sq. ft., despite continued move-ins from previously signed deals.

Notable Development:

- Autry Park broke ground in May 2025

- The 126,000 sq. ft. office project is already 77% pre-leased

- A Phase II is now in planning due to strong pre-leasing momentum

Houston's overall office availability rate dropped to 25.9%, down 40 basis points from Q1 and down 130 bps year-over-year. Sublease availability edged up slightly to 2.7%, but remains stable YoY.

Industrial Market: High Demand, Lower Vacancy

Houston’s industrial sector continued to perform well in Q2, with 2.9 million sq. ft. of net absorption through the first half of 2025, most of it occurring in the second quarter.

Vacancy fell 10 basis points to 6.2%, as tenant move-ins once again outpaced new supply—a trend that has held in five of the last seven quarters.

Construction remains strong, with 17.8 million sq. ft. of industrial space currently underway, though only 10% is pre-leased—a sign of speculative confidence.

Port of Houston Impact: The Port continues to be a major growth engine.

- Handled over 1.8 million TEUs through May

- 4.4% increase YoY in container volume

- Resilient despite ongoing trade policy uncertainty

Market Takeaways: Houston CRE Outlook

- Office Recovery Is Uneven: Class A space is leading the recovery, while Class B remains under pressure.

- Development Is Targeted and Measured: New projects like Autry Park are advancing only with strong pre-leasing in hand.

- Industrial Remains a Standout: Tenant demand, port activity, and developer confidence remain strong despite macro headwinds.

- Sublease Space Still a Factor: Though not spiking, sublease availability will remain a metric to watch as corporate strategies evolve.