How to Invest in AI Through Real Estate

By Andres Cisneros-Romo

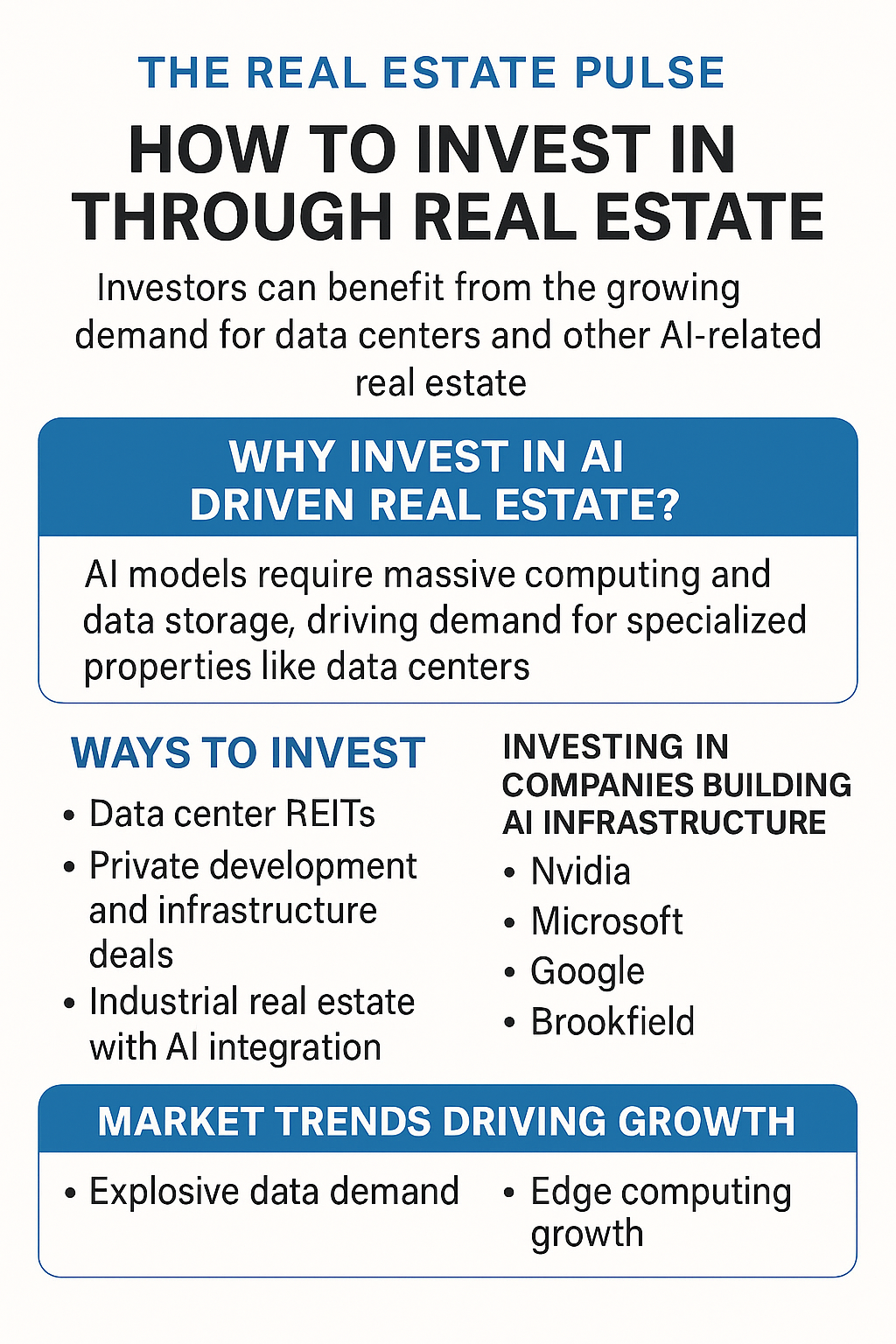

Artificial Intelligence (AI) is transforming industries at an unprecedented pace—and with it, the demand for the physical infrastructure that powers AI is surging. Data centers, high-tech industrial spaces, and energy-intensive facilities have become critical assets for companies developing and deploying AI. For real estate investors, this presents a unique opportunity to participate in the AI revolution by investing in the properties and companies that support this ecosystem.

Why AI and Real Estate Are Connected

AI models require massive amounts of computing power, data storage, and energy. This need has triggered an expansion of data centers, facilities that house advanced servers and high-performance GPUs. These buildings are specifically designed with redundant power, specialized cooling systems, and high-speed connectivity—making them mission-critical assets for tech giants like Microsoft, Google, and Amazon, as well as AI leaders like Nvidia.

Ways to Invest in AI-Driven Real Estate

1. Data Center REITs

One of the easiest entry points for retail investors is through Real Estate Investment Trusts (REITs) that specialize in data centers. These REITs generate income by leasing server space to cloud service providers and large enterprises. Key players include:

- Equinix (EQIX) – A global leader with over 250 data centers.

- Digital Realty Trust (DLR) – Operates a vast portfolio of data and colocation facilities.

- CoreSite (COR) – Focuses on high-demand U.S. metro markets.

2. Private Funds and Development Projects

Private equity and infrastructure funds are increasingly targeting hyperscale data center developments. These investments require significant capital but can yield strong returns once facilities are leased to major tech companies or cloud service providers.

3. Industrial Real Estate with AI Integration

AI isn’t just transforming data centers—it’s also revolutionizing logistics and warehousing. Industrial REITs like Prologis (PLD) and Rexford Industrial (REXR) benefit from automation and AI-driven supply chain operations, making these assets future-proof and highly valuable.

4. Investing in Companies Building AI Infrastructure

Another strategy is investing directly in companies developing AI infrastructure:

- Nvidia (NVDA) – The leader in AI computing chips.

- Microsoft (MSFT) – Expanding Azure AI cloud data centers.

- Google (GOOGL) – Leading the AI race with infrastructure expansions.

- Brookfield Infrastructure (BIP) – Diversifying into digital infrastructure, including data centers.

Market Trends Driving Growth

- Explosive Data Demand: Generative AI models like ChatGPT require massive server capacity, pushing data center growth.

- Edge Computing: Smaller, localized data centers are growing in demand due to real-time AI applications such as autonomous vehicles.

- Sustainability: AI data centers are energy-intensive, creating opportunities for green energy partnerships and innovation.

Risks to Consider

- Energy Costs: The high-power usage of AI servers can impact profitability.

- Technological Obsolescence: Rapid innovation may require frequent property and infrastructure upgrades.

- Market Competition: New entrants and overdevelopment in certain markets can affect lease rates.

The Bottom Line

Investing in AI through real estate is about owning the digital backbone of the future. Whether through data center REITs, private developments, or AI infrastructure companies, the opportunities are significant for investors who understand this rapidly evolving sector.