Is the Housing Market About to Stall the U.S. Economy?

By Andres Cisneros-Romo

July 17, 2025

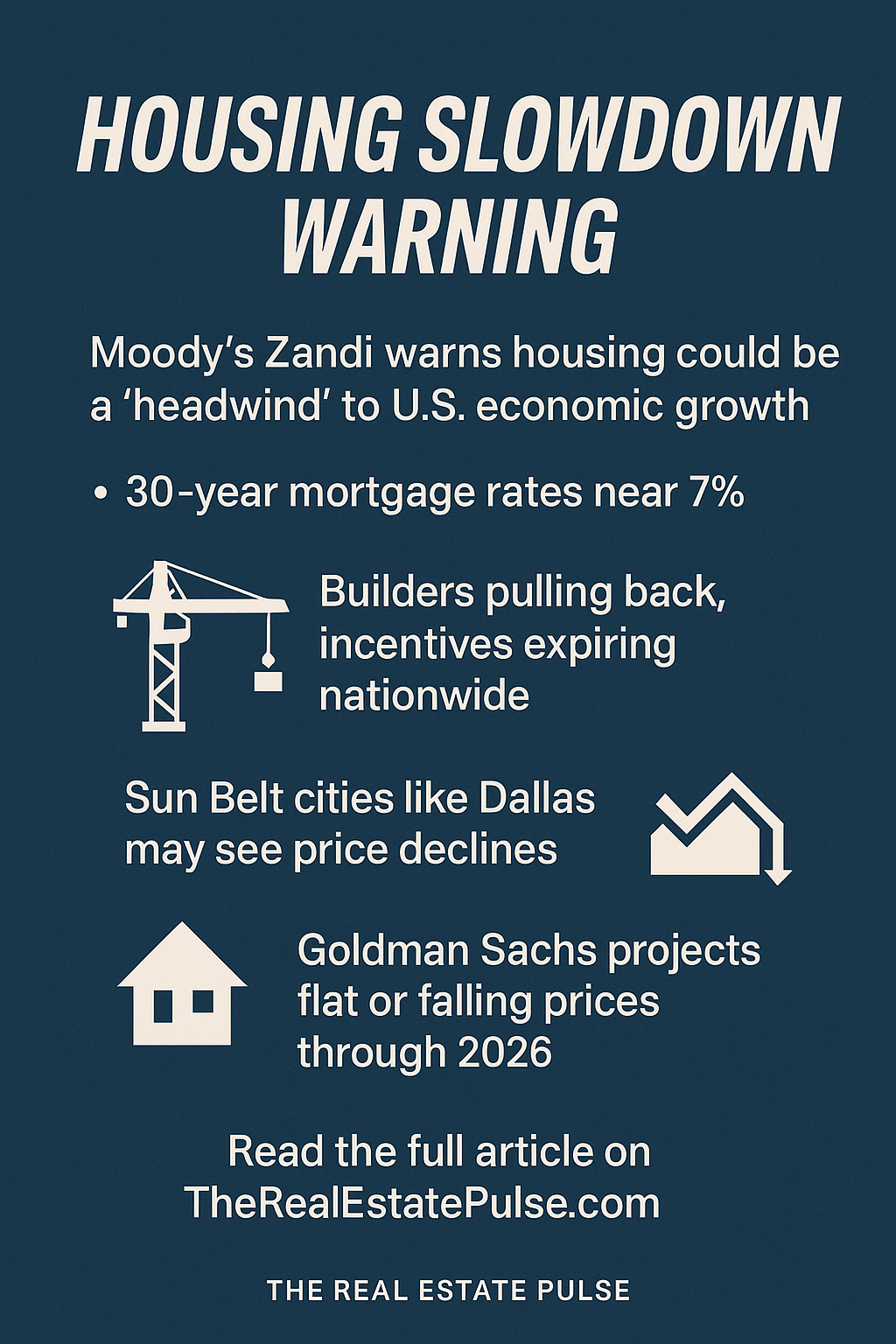

Mortgage rates remain stubbornly high. Homebuyers are retreating, and economists are raising red flags including Moody’s chief economist Mark Zandi, who says housing may soon drag the broader U.S. economy into trouble.

In a recent statement on LinkedIn and X, Zandi warned that the U.S. housing market is approaching a tipping point. His message? “Housing will … soon be a full-blown headwind to broader economic growth.”

Here’s what you need to know.

The Core Problem: Rates Near 7%

Home sales, new home construction, and even housing prices are under pressure as 30-year fixed mortgage rates hover around 6.8%–7%. That means fewer buyers can qualify, and many current homeowners locked into ultra-low pandemic-era mortgage rates see no reason to move.

Example: A $425,000 home with 10% down now carries a monthly mortgage cost of nearly $2,900 — a steep hurdle for most working-class families, especially considering the U.S. median household income is around $75,000 per year. — a steep hurdle for most working-class families.

Unless mortgage rates drop meaningfully, Zandi says, the market won’t recover. But that drop seems unlikely anytime soon, as mortgage rates tend to move with the 10-year Treasury yield, not directly with the Fed’s benchmark rate.

Builders Are Pulling Back

With demand waning, even new homebuilders who’ve offered aggressive incentives like mortgage rate buydowns are starting to back off. Zandi notes many are now delaying land purchases entirely.

That means fewer new homes started and fewer construction jobs created a slowdown that could spill over into materials, finance, and real estate sectors.

Home Prices Are Stalling

While national housing prices won’t crash, the pace of growth is slowing fast. According to a July 2025 note from Goldman Sachs:

- Home prices will grow just 0.5% in 2025

- Only 1.2% growth is expected in 2026

- That’s a steep drop from 2021–2022 pandemic gains

Goldman expects 15% of metro areas to see price declines of over 5%, especially in former boomtowns like Dallas, Miami, Orlando, and Nashville.

These markets were among the fastest rising in recent years, but high supply, slowing migration, and affordability pressures have shifted the balance.

A Broader Economic Risk

As housing slows, the ripple effect could be wide:

- Fewer home sales → less spending on furniture, appliances, services

- Fewer builds → fewer construction and materials jobs

- Flat or falling prices → less homeowner equity and confidence

Zandi’s warning is part of a growing consensus that housing once a pillar of post-COVID recovery is becoming a liability for the 2025 economy.

Final Take: Watch Mortgage Rates

Unless we see a significant drop in rates, affordability will remain a barrier especially for first-time buyers and working families.

With inventory rising but buyers still hesitant, price cuts and listing withdrawals are likely to continue, particularly in overheated Sun Belt markets like Dallas and Orlando, where affordability has deteriorated more quickly than in the Northeast or Midwest. For industry professionals, that means recalibrating expectations and watching rate and inflation trends closely in Q3 and Q4.

Sources:

📌 MarketWatch: Housing market is sending a stark warning to the U.S. economy, Moody’s economist says

📌 Goldman Sachs July 2025 Home Price Forecast

📌 Mortgage News Daily, July 2025

Want more insights on real estate and housing trends?

Subscribe to The Real Estate Pulse for data-backed commentary, local spotlights, and market strategy.