Opportunity Zones Explained: A Tax-Advantaged Path to Impact Investing (While It Lasts)

By Andres Cisneros-Romo

July 13, 2025

We all want to build wealth—and ideally, keep more of it. What if there was a way to reduce, defer, or even eliminate capital gains taxes while investing in underserved communities across the U.S.? That’s the core idea behind Opportunity Zones, one of the most powerful (yet misunderstood) tools in the modern real estate and investment playbook.

But as 2026 approaches, time is running out to take full advantage of this tax break. In this article, we’ll break down exactly how Opportunity Zones work, why they matter, and whether they still make sense in 2025.

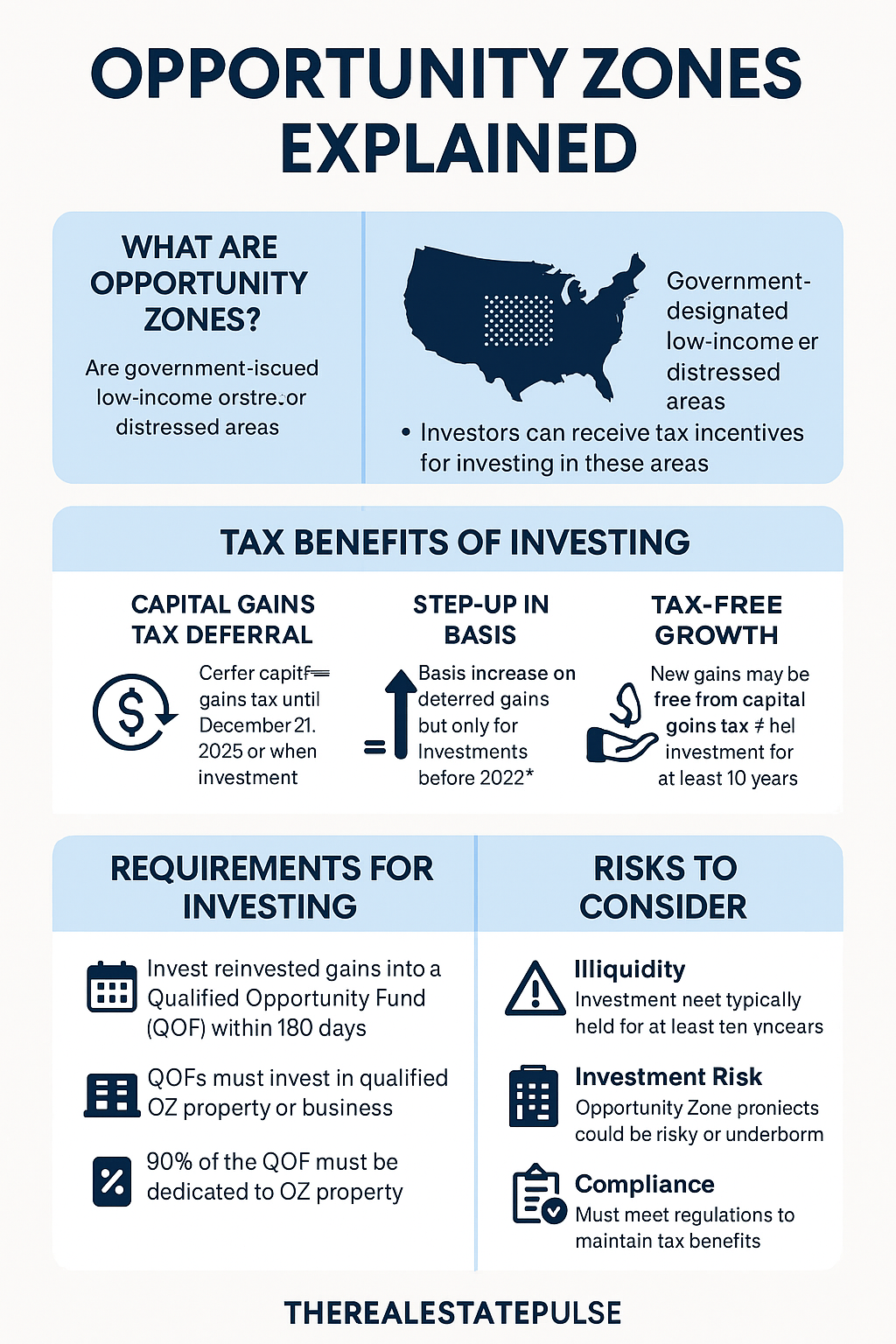

What Are Opportunity Zones?

Opportunity Zones (OZs) are economically distressed areas designated by the federal government to encourage long-term investments and stimulate economic growth. There are over 8,700 zones across all 50 states, Washington D.C., and U.S. territories.

The idea is simple:

Investors who reinvest capital gains into these areas via Qualified Opportunity Funds (QOFs) receive tax incentives—in exchange for helping fuel business and real estate development in areas that need it most.

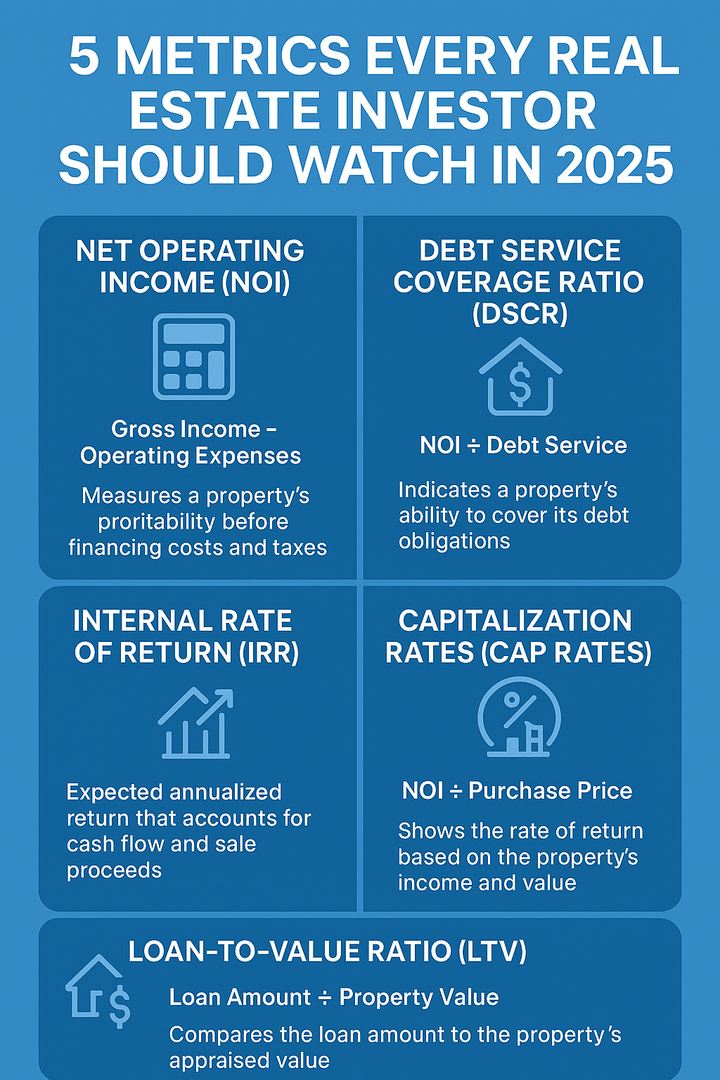

How the Tax Benefits Work

Opportunity Zone investing offers three major tax advantages:

1. Capital Gains Tax Deferral

If you realize a capital gain (say, from selling stocks, real estate, or a business), and reinvest that gain into a QOF within 180 days, you can defer paying taxes on the original gain until December 31, 2026, or until you sell your OZ investment (whichever comes first).

This means you get to keep your full pre-tax capital gain working for you in the meantime.

2. (Expired) Step-Up in Basis

Originally, if you held an OZ investment for 5 or 7 years, you could reduce the taxable portion of your original gain by 10% or 15%. However, to qualify for these reductions, you needed to invest by the end of 2021 (for the 5-year benefit) or 2019 (for the 7-year benefit). So for new investors in 2025, this benefit is no longer available.

3. Permanent Tax-Free Growth

The biggest reward: if you hold your OZ investment for at least 10 years, any gains earned on that investment become 100% tax-free. That’s right—no capital gains tax on appreciation.

Hypothetical Example: OZ vs. Traditional Investment

Let’s say you just sold a property and realized a $5 million capital gain. You have two options:

| Traditional Investment | Opportunity Zone Fund | |

|---|---|---|

| Capital Gains Tax Now | $1.19M (23.8%) | $0 (deferred to 2026) |

| Initial Investment | $3.81M | $5.00M |

| 10-Year Value (2x) | $7.62M | $10.00M |

| Tax on New Gain | $905K | $0 |

| Final After-Tax Total | ~$6.71M | ~$8.81M |

Result: The OZ investment generates about $2.1M more after tax.

Requirements for Investing

To qualify for the tax benefits, investors must:

- Reinvest a capital gain (not ordinary income) into a QOF within 180 days of the gain realization.

- File a special election on their tax return to defer the gain.

- Hold the investment in the fund for 10+ years to earn tax-free growth.

- Choose a fund that complies with OZ rules, including using 90% of assets for qualified Opportunity Zone property or businesses.

Risks and Considerations

Despite the benefits, Opportunity Zones are not a guaranteed win. Here’s why:

Illiquidity

OZ investments are not liquid. To get the full benefit, you need to hold the asset for 10+ years—meaning you should be comfortable leaving that money untouched.

Investment Quality Varies

The tax perks don’t protect you from a bad investment. Many QOFs are tied to real estate development or business startups in high-risk or emerging markets. Do your due diligence.

Timing Pressures

You must meet the 180-day rule, and the 2026 capital gains tax deadline is fast approaching. Compliance is crucial—both at the investor and fund level.

Tax Law Risk

While current rates are favorable, tax policy could shift. However, with the recent 2025 tax reform being investor-friendly, risk appears low for now.

Should You Invest in an Opportunity Zone?

OZs are best suited for:

- Investors with large capital gains looking to defer tax.

- Individuals with long-term investment horizons.

- Those seeking impact + return by contributing to community development.

They’re not ideal if:

- You may need liquidity in the next 5–10 years.

- You're looking for ultra-safe or conservative investments.

- You don’t have capital gains to invest.

Final Take: Still Worth It in 2025?

Yes, with some caveats.

The step-up basis benefits may be gone, but the 10-year tax-free appreciation remains powerful. If you’ve realized a gain and want to invest in real estate or growth-oriented businesses, OZs can still offer one of the most compelling after-tax returns available today.

But the clock is ticking—all deferred capital gains are due by 2026. So if you're considering it, now's the time to get educated, evaluate funds, and consult your financial team.

Sources:

- WealthGen Advisor – Opportunity Zones in 2025: Is It Too Late to Invest?

- IRS – Opportunity Zones Frequently Asked Questions

- Wells Fargo Private Bank – Qualified Opportunity Zones Insight

- McDermott Will & Emery – The 90% Asset Test

📬 Want more in-depth breakdowns like this? Subscribe to TheRealEstatePulse for weekly insights across policy, investment, and market intelligence.