Prologis Shows Strength in Q2 2025 With Build-to-Suit Strategy

By Andres Cisneros-Romo

July 17, 2025

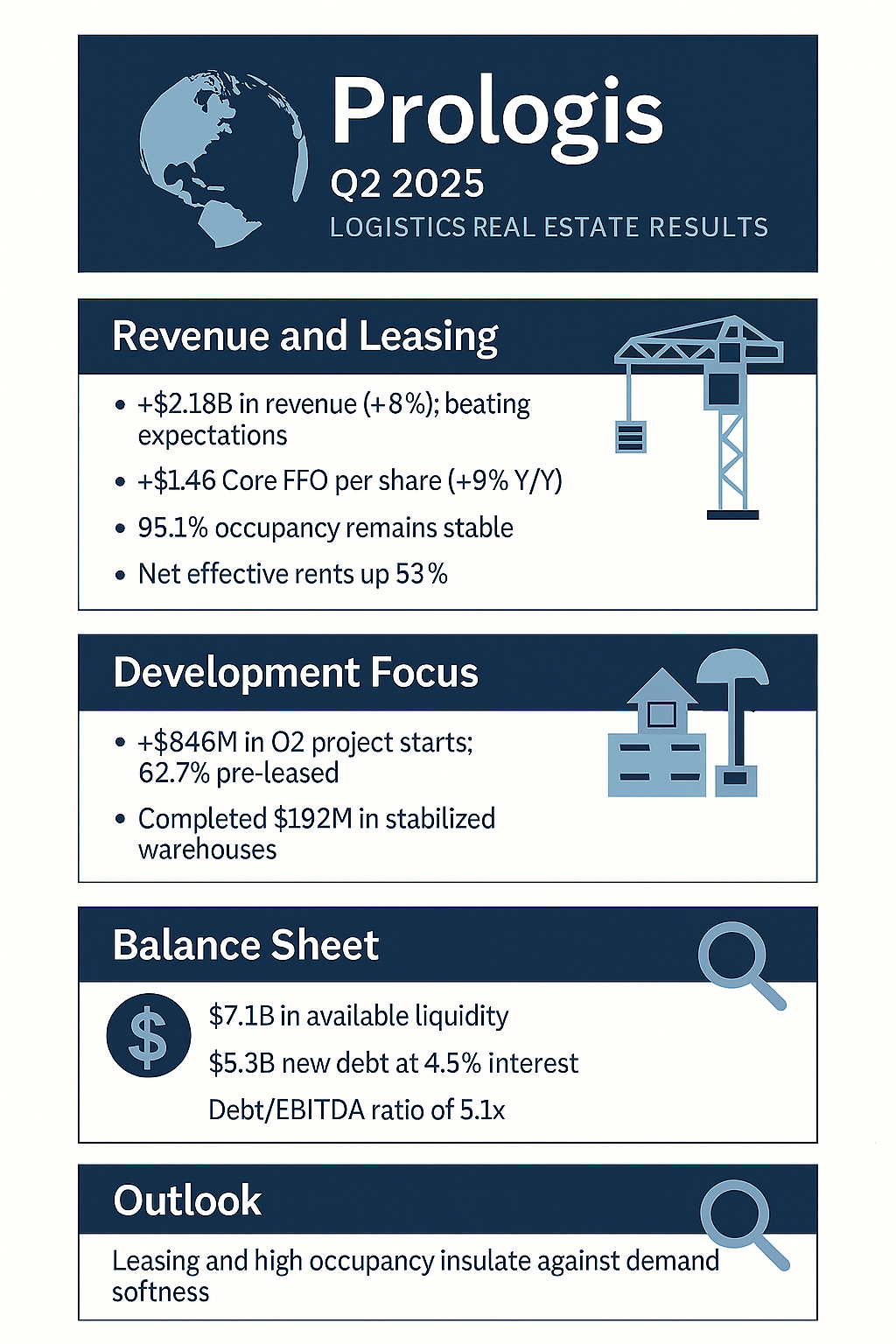

Despite a cooling industrial market nationwide, Prologis reported strong operational results in Q2 2025. Leaning into pre-leased, build-to-suit development and maintaining stable occupancy as national vacancy rates rise.

Prologis is the world’s largest logistics real estate company, specializing in the development, ownership, and operation of high-quality industrial properties. The company’s global portfolio supports supply chain operations for e-commerce, retail, manufacturing, and transportation customers.

Revenue and Core Earnings Outperform

Prologis generated $2.18 billion in revenue in Q2, up from $2.01 billion last year and beating analyst expectations. While net income dropped 33.7% to $571 million due largely to reduced real estate gains and foreign exchange losses. Core Funds from Operations (FFO) rose 9% year-over-year to $1.46 per share.

That metric, closely watched by real estate investors, prompted Prologis to raise its full-year FFO guidance to a range of $5.75 to $5.80.

Leasing, Occupancy, and Rents Stay Strong

Operationally, Prologis continues to outperform its peers:

- Occupancy held steady at 95.1%

- Leased 51.2 million square feet in the quarter, with a 74.9% retention rate

- Cash same-store NOI grew 4.9%

- Net effective rents surged 53.4%, with cash rents up 34.8%

These figures underscore the strength of Prologis’ global logistics portfolio, even as industrial absorption slows in some U.S. markets.

Development Focus: Pre-Leased, Build-to-Suit

Facing a more cautious industrial environment, Prologis shifted development strategy toward build-to-suit projects, custom-designed and pre-leased properties. In Q2, the company:

- Broke ground on $846 million in development starts

- 62.7% of new development was pre-leased

- Completed $192 million in stabilized properties at a 6.9% yield

Management also raised full-year development guidance to $2.25–2.75 billion, up from $1.5–2 billion.

Recent Projects

Prologis’s recent pipeline shows momentum in two areas:

- Build‑to‑Suit Warehouses

– Over $900 million in new development starts during Q2, nearly triple Q2 2024 levels.

– Approximately 65% of this was build‑to‑suit, pre‑leased to major retailers, consumer goods companies, and auto parts manufacturers. - Strategic Data‑Center Adjacent Projects

– In the first half of 2025, $1.1 billion of build‑to‑suit starts included approximately $300 million earmarked for continued data‑center infrastructure expansion in Austin, TX, anchored by a top-tier hyperscale.

These developments demonstrate Prologis’s ability to capture high-demand, industry-specific spaces — leveraging its scale and customer relationships.

Balance Sheet: Strong and Flexible

Prologis remains well-capitalized:

- $7.1 billion in available liquidity

- Debt/EBITDA at 5.1x

- Issued $5.8 billion in new debt this year at 4.5% average interest

- Weighted average debt maturity: 8.5 years

This financial flexibility enables Prologis to navigate interest rate volatility and continue deploying capital into high-yield opportunities.

Outlook: Navigating a Softer Market with Confidence

While national warehouse vacancy hit a 10-year high of 7.1% in Q2, Prologis appears insulated thanks to its disciplined, pre-leased development model and global customer base.

In an industrial market that’s shifting from speculative growth to performance-driven execution, Prologis is leaning into its strengths: scale, data, and discipline.

Sources:

📌 Prologis Q2 2025 Earnings Release

📌 Wall Street Journal – Prologis ramps up plans for new warehouse construction

📌 Mortgage News Daily & Mitrade Analysis

Want more insights on logistics, CRE earnings, and market strategy?

Subscribe to The Real Estate Pulse for analysis that cuts through the noise.