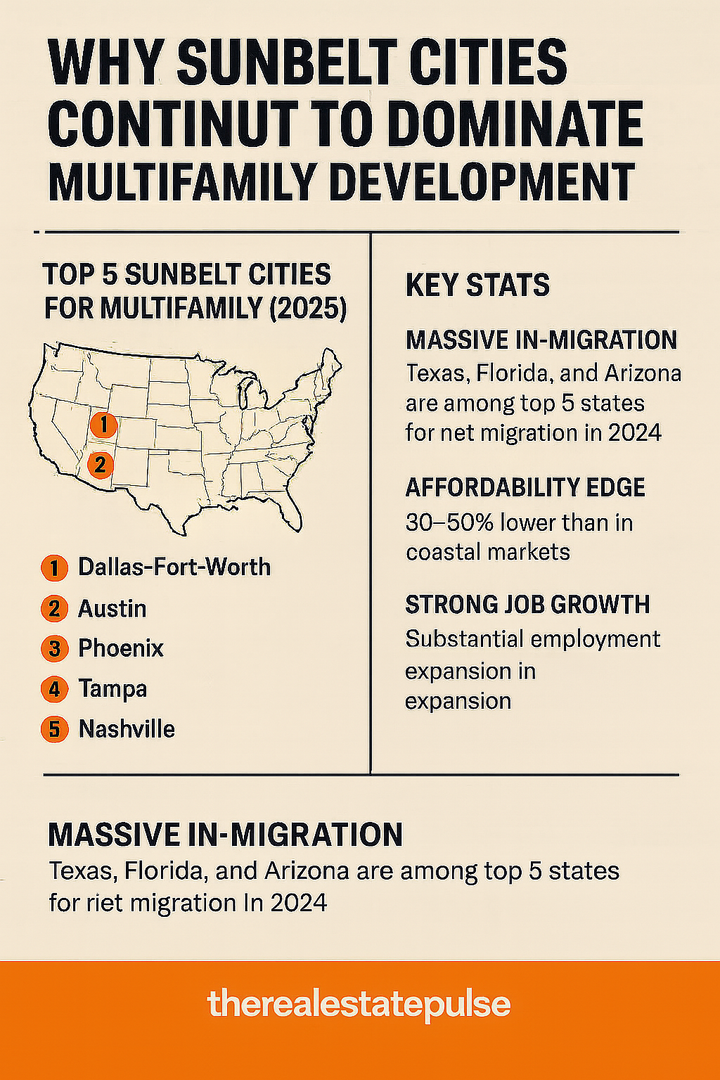

San Antonio Q2 2025 Market Snapshot: Office Stays Flat While Industrial Absorption Rebounds

July 7, 2025 | By TheRealEstatePulse Editorial Staff

Despite broader economic caution, San Antonio’s commercial real estate market showed signs of resilience in the second quarter of 2025, particularly in the industrial sector. While the office market remained relatively stable—with limited leasing momentum—the industrial market saw a notable rebound in activity and absorption.

Office Market: Modest Momentum, Stable Vacancy

The San Antonio office market held relatively steady in Q2, with positive net absorption of 83,850 sq. ft. citywide. Vacancy remained unchanged at 19.9%, maintaining quarter-over-quarter levels across both Class A and B assets.

Leasing volume slowed significantly, totaling just under 290,000 sq. ft. during the quarter. A closer look reveals that new leases accounted for 66.7% of leasing activity, while renewals and one extension made up the remaining third. Notably, nearly 25% of renewals included expansions, indicating that some tenants are quietly scaling up within their existing footprints.

Key driver: The Professional Services sector dominated office leasing activity, representing 57.2% of total leasing volume.

While Class A asking rents declined slightly to $33.95 per sq. ft., Class B saw a minor increase, averaging $26.51 per sq. ft. However, overall rent averages may be misleading. Much of the available space dragging averages down is lower quality. Top-tier trophy spaces in Midtown and the CBD continue to command premium rates between $60.00 and $65.00 FSG/year, reflecting strong demand for best-in-class space in core submarkets.

Industrial Market: Activity Picks Up, Vacancy Shrinks

San Antonio’s industrial sector outpaced expectations in Q2, with marketwide vacancy dropping 20 basis points to 10.5%. This was driven by large occupiers expanding or relocating into bigger spaces, resulting in net absorption just under 500,000 sq. ft.

A significant slowdown in new deliveries also played a role. After 5.8 million sq. ft. of new industrial product came online in the last four quarters, the pipeline paused, giving the market a chance to stabilize and digest prior development.

Leasing activity jumped to 1.6 million sq. ft., more than doubling from Q1’s 654,148 sq. ft.

Occupier behavior: Many tenants remain cautious. Instead of moving into speculative new construction, they’re choosing to renew in place, keeping absorption numbers moderate and prolonging vacancy in new distribution centers.

Economic uncertainty, rising construction costs, and tariff-related concerns continue to encourage a “wait-and-see” approach for industrial users—though the Q2 spike in leasing could signal the early stages of a rebound in tenant confidence.

Outlook: San Antonio Navigating Market Cycles with Caution

- Office remains tenant-favorable in most submarkets, with attractive concessions and stable rents outside trophy assets.

- Industrial is showing signs of rebalancing, with activity increasing and deliveries pausing at a time when caution still defines tenant decision-making.

As the broader economic picture becomes clearer in the second half of the year, San Antonio's positioning—buoyed by population growth, affordability, and central geography—may attract renewed attention from occupiers and investors alike.