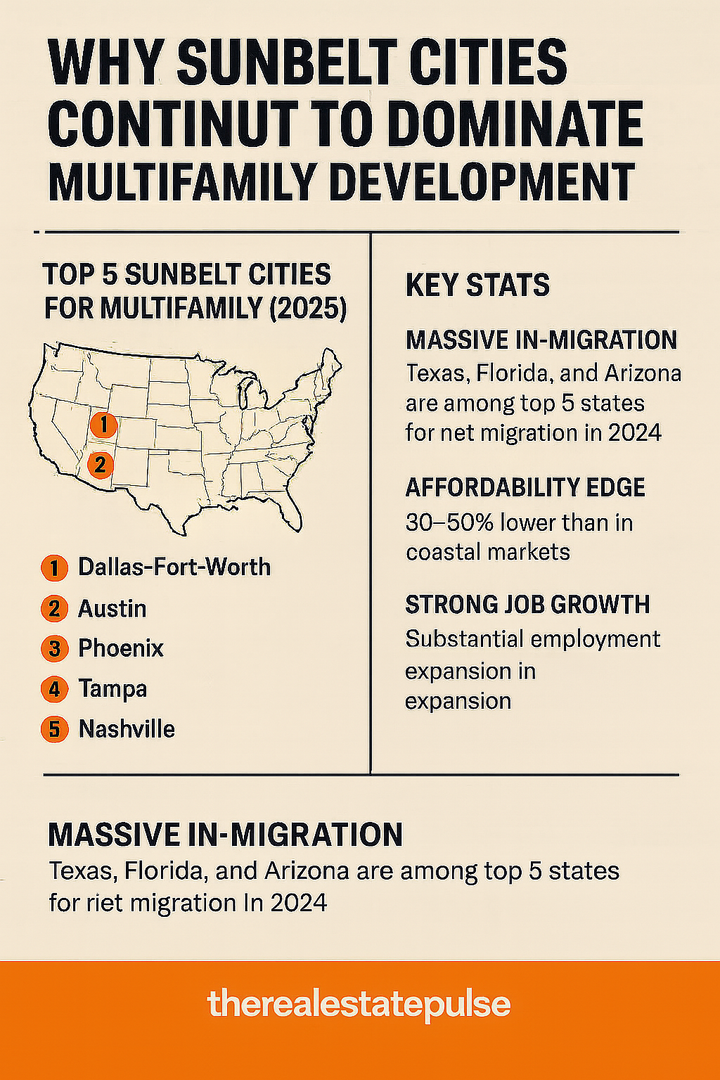

Where U.S. Investors Are Looking Abroad in 2025

By Andres Cisneros-Romo

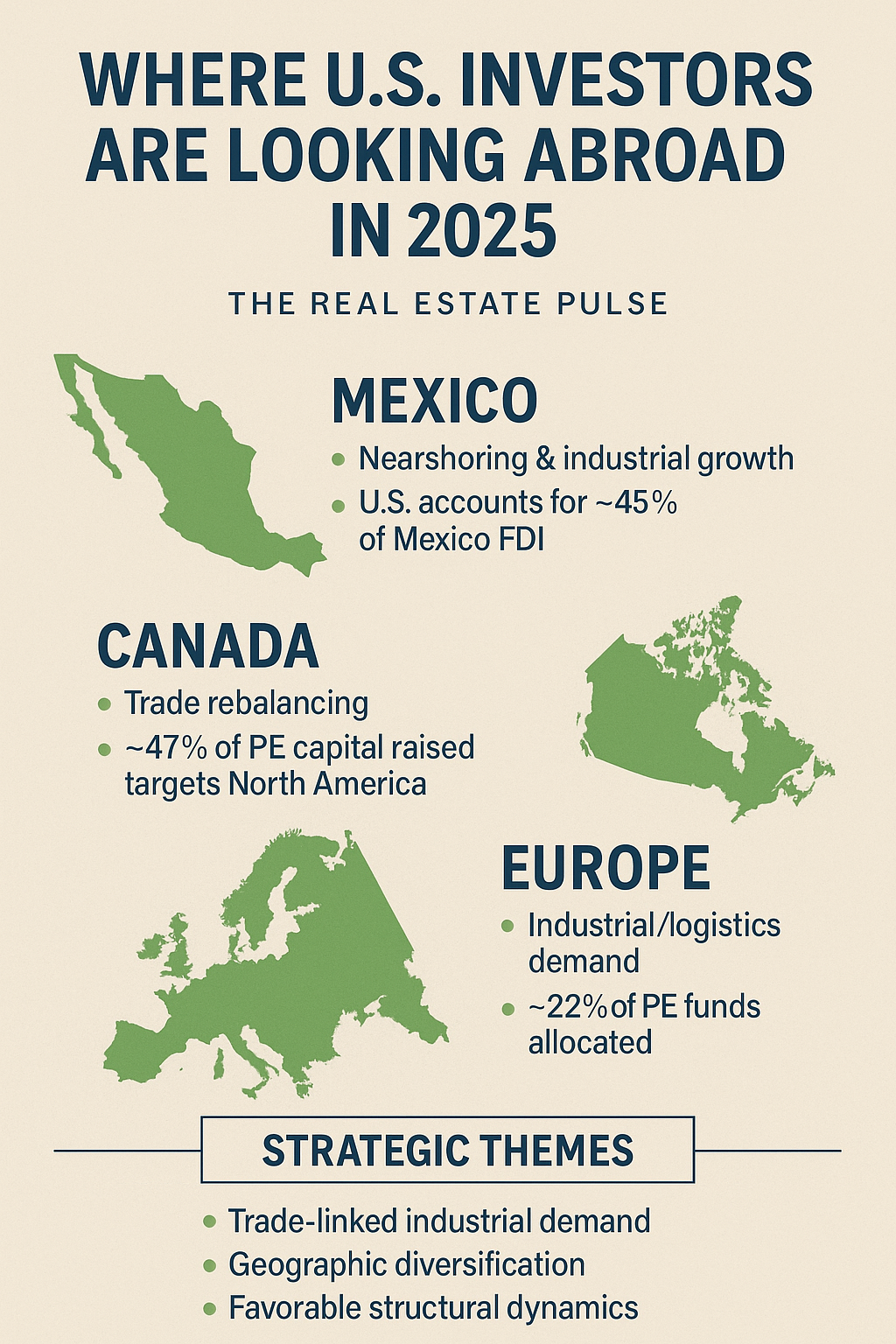

In 2025, U.S. real estate investors are strategically expanding beyond domestic markets, targeting international opportunities in Mexico, Canada, and European industrial real estate. These areas appeal due to trade-linked industrial growth, diversification benefits, and favorable structural dynamics.

Mexico: Nearshoring & Industrial Expansion

Mexico has emerged as a key focus for U.S. investors amid escalating nearshoring trends. Foreign direct investment rose about 1.1% in 2024, with the U.S. accounting for roughly 45% of Mexico’s FDI—a reflection of integrated manufacturing supply chains and industrial real estate potential Newmark+2Global Practice Guides+2House Beautiful+2.

Industrial parks near U.S. border crossings and major inland logistics hubs have become especially attractive. Developers are tapping into demand from reshoring manufacturers and increased trade flows amid changes in American trade policy NewmarkGlobal Practice Guides.

Canada: Trade Rebalancing & Long-Term Growth

Canada’s industrial real estate market is adapting to evolving trade dynamics as the country reassesses economic ties to mitigate global exposure. The government is investing in east-west trade infrastructure and fostering domestic manufacturing resilience Newmark.

Meanwhile, institutional capital from the U.S. and Canada is growing—nearly 47% of the private equity real estate capital raised over the past year targeted North America, underscoring strong investor interest, including cross-border flows.

Europe: Stable Yields & Institutional Participation

European industrial markets are attracting U.S. investor capital looking for stable returns and geographical diversification. Private equity raised in 2025 allocated roughly 22% toward European property markets—a meaningful share behind North America.

Major global players, including Canadian institutions like CPP Investments, have invested alongside partners such as Greystar and KKR, acquiring industrial and logistics assets in Germany, France, and beyond.

Europe’s lower loan maturity concentrations over the next couple of years and more predictable debt markets have also increased institutional confidence DeloitteDWS Asset Management.

Macroeconomic & Strategic Forces Driving Global Allocation

Several overarching themes are driving U.S. investor interest abroad:

- Deglobalization and tariff uncertainty are prompting investors to hedge domestic exposure and diversify global portfolios PERE.

- The recalibration of global supply chains—escalating nearshoring and regional logistics infrastructure upgrades—are fueling industrial demand in North America and Europe knowledge.uli.org+3jpmorgan.com+3pwc.com+3.

- Private equity real estate funds continue to rebalance allocations toward non-U.S. regions, with capital flows rising into Mexico and Europe alongside continued interest in Canada.

Risk & Opportunity Outlook

- Mexico offers long-term industrial growth potential, but investors must navigate evolving trade policy, currency volatility, and local regulatory regimes.

- Canada remains relatively stable and transparent, though its industrial markets may offer lower yield spreads compared to Mexico or Europe.

- Europe can provide attractive yields—especially in logistics nodes—but requires fluency in country-specific regulations, debt structures, and tenant dynamics.

Investor Takeaways

- Focus on industrial real estate, especially logistics hubs and supply-chain-aligned properties in Mexico, Canada, and European markets.

- Diversify geographically to mitigate U.S.-specific risks such as interest rate volatility and domestic overexposure.

- Evaluate capital inflows and debt landscape when entering Europe, where credit availability remains more measured than in North America.

Key Stats at a Glance

| Region | Capital Allocation Share (PE Funds, past 12 mo) | Industrial Drivers |

|---|---|---|

| Canada & U.S. | ~47% | Trade infrastructure, nearshoring |

| Europe | ~22% | Stable income, lower debt clustering |

| Mexico | ~45% of Mexico's FDI from U.S. | Nearshoring, integrated manufacturing supply chain |

Conclusion

In 2025, U.S. real estate investors are broadening their horizons by targeting markets beyond the domestic landscape. Mexico, Canada, and Europe each offer distinct opportunities, particularly in industrial and logistics segments tied to manufacturing and trade shifts. By leveraging these trends, U.S. capital can unlock diversification benefits and potential yield advantages amid a shifting global economic backdrop.