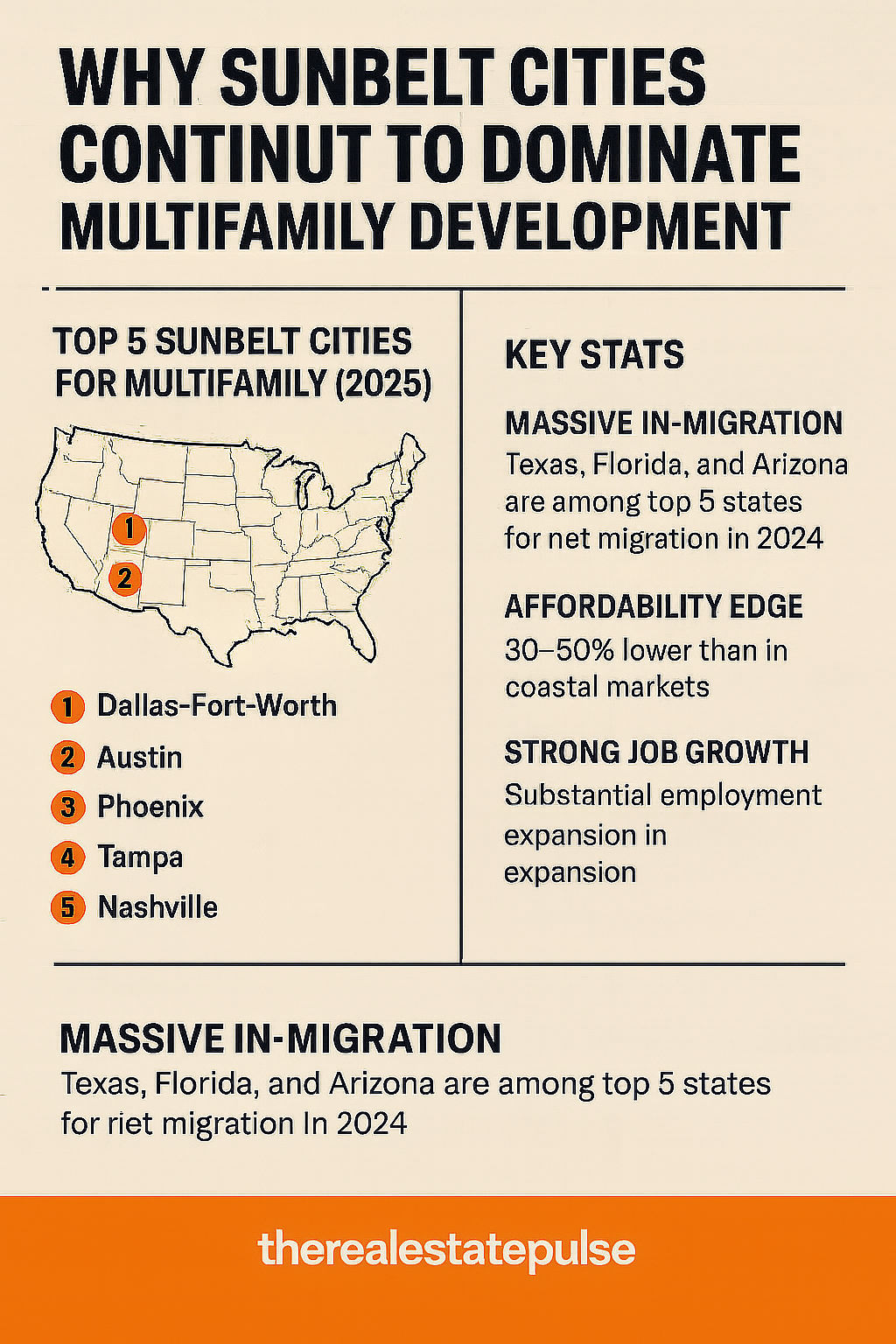

Why Sunbelt Cities Continue to Dominate Multifamily Development

By Andres Cisneros-Romo

The Sunbelt has become the epicenter of multifamily growth, attracting renters, investors, and developers alike. From Austin to Tampa, these cities are setting the pace for U.S. housing trends thanks to a winning combination of migration, job creation, and affordability. As the rest of the country faces sluggish population growth and cost pressures, the Sunbelt continues to shine.

1. Migration Patterns Fueling Demand

The Sunbelt has experienced massive population inflows, particularly since the pandemic reshaped where Americans want to live and work. Texas, Florida, and Arizona rank among the top five states for net migration in 2024, according to the U.S. Census Bureau.

Key drivers include:

- Remote and hybrid work flexibility, allowing people to leave high-cost coastal markets.

- Warm weather and outdoor-friendly lifestyles.

- Tax advantages, especially in states like Texas and Florida where there is no income tax.

Texas alone has added more than 500,000 new residents since 2020, pushing rental demand to record highs in markets like Dallas-Fort Worth and Houston.

2. Economic Strength and Job Growth

Sunbelt metros are booming with corporate relocations, diversified industries, and strong labor markets.

- Dallas-Fort Worth is thriving as a finance and tech hub, with major expansions from Goldman Sachs and Charles Schwab.

- Austin continues to draw tech investment from Tesla, Apple, and Oracle.

- Phoenix and Nashville are benefiting from healthcare, manufacturing, and entertainment growth.

This economic vibrancy attracts a younger workforce, particularly the 25-to-40 age group, which prefers renting and fuels demand for multifamily housing.

3. Affordability Edge vs. Coastal Markets

Even as rents rise, Sunbelt cities remain 30–50% cheaper than coastal markets like New York, Los Angeles, and San Francisco. Average Class A rents in Dallas ($1,650) or Atlanta ($1,700) remain well below the national average, according to Yardi Matrix.

With lower land costs and construction expenses, Sunbelt markets offer developers and institutional investors higher yields and better returns.

4. Development Pipelines and Investor Confidence

Nearly half of all new multifamily units under construction in 2025 are located in Sunbelt metros, according to RealPage data.

Investors are targeting the region due to:

- Strong in-migration, which ensures steady occupancy.

- Business-friendly policies and fewer zoning restrictions.

- Institutional capital flows, with firms like Blackstone and Greystar doubling down on Sunbelt investments.

5. The Road Ahead

While some metros, like Austin, have seen rent declines of over 11% year-over-year due to oversupply, these markets remain attractive for long-term investment. Population growth and job creation are expected to drive demand well into 2030.

Developers who focus on strategic submarkets, such as those near employment hubs, mixed-use developments, and transit-accessible areas, are best positioned to capture future growth.

Key Takeaway:

The Sunbelt isn’t just a trend — it’s a structural shift in U.S. housing dynamics. With strong fundamentals and favorable economics, the region will continue to lead the multifamily sector in the coming decade.

Investor Insight

- Top Markets to Watch (2025–2030): Dallas-Fort Worth, Austin, Phoenix, Tampa, Nashville, Atlanta.

- Cap Rate Advantage: Sunbelt Class A multifamily properties offer cap rates that are 50–100 basis points higher than coastal markets, enhancing returns.

- Emerging Play: Secondary Sunbelt cities like Raleigh, Knoxville, and Huntsville are gaining traction due to affordability and job growth.